Welcome to the ultimate guide on betting sites with no tax in Kenya 2026! We know that finding the perfect platform to place your bets while avoiding those pesky taxes can be quite the challenge. Fret not, as we’ve meticulously scoured the bookmakers’ world to compile this comprehensive guide of the top including international betting sites that accept Mpesa and allow betting without tax in Kenya.

As is our norm, these handpicked selections are top-notch companies not only offering an incredible array of markets and competitive odds, but also ensure you keep every penny of your hard-earned winnings. Some of the ideas discussed here may require some degree of technical know-how, but worry not as we shall explain fully. Without further ado, let’s unravel the bookies’ world including international betting sites with no tax in Kenya as well ones that accept Mpesa, crypto, etc!

Jump to Section:

If you find this page useful, kindly bookmark or share it on social media. You can Contact Us Here on any issues on this page or concerning this bookmaker.

Are there Betting Sites in Kenya with NO TAX?

Short Answer: for any licensed Kenyan betting site, “no tax” is basically not a thing. By law, all properly licensed bookmakers have to apply betting taxes – the only way you “see no tax” as a punter is either because:

Short Answer: for any licensed Kenyan betting site, “no tax” is basically not a thing. By law, all properly licensed bookmakers have to apply betting taxes – the only way you “see no tax” as a punter is either because:

1. The bookie is paying the tax on your behalf (you don’t see the deduction, but KRA still gets paid), or

For example, one Kenyan comparison site explains that some international betting sites “pay the tax on behalf of their customers”, so your KES 5,000 win still hits your wallet as 5,000, even though the bookie is quietly remitting tax behind the scenes

Some international/local sites may advertise as ‘betting sites in Kenya without tax’ but what they really mean is:

“We still pay the 5% excise + 5% WHT to KRA, but we absorb the cost from our own margin so your payout looks tax-free.”

2. The site is offshore / unlicensed in Kenya, not following Kenyan tax rules (risky and legal).

Key issues:

- Many of these are licensed in foreign jurisdictions, not by the BCLB. For example, a company like Stake or Bet365 is a reknown global bookie though has a foregin license in the UK and associate islands. It accepts players from all over the world and uses internationally accepted payment systems such as VISA, Mastercard, crypto etc., thereby enabling players to easily fund and withdraw from their accounts. However, most local payments such as mobile transfers are not integrated making them suitable only for the savvy players.

- Kenyan law still expects tax on betting, but enforcement against offshore operators is tricky, hence why you might not see any tax at all on these sites as they operate under international laws/jurisdictions.

- That’s why Kenyan media warn that “betting sites in Kenya with no tax” are a concern and may involve tax dodging or regulatory risk. However, most of the time, the grayness does not imply illigality – these international sites are still regulated under more strict consumer protection laws that are often stronger than Kenyan laws.

So yes, you may find sites that behave like they have no tax, but they are outside the Kenyan regulatory net, and you’re taking on extra risk (no local dispute resolution, possible KYC issues, funds blocked, etc.)

10 Best Betting Sites With No Tax in Kenya (on Stakes & Winnings)

A thorough sneak into the bookmakers world of Kenya got us running tests in all the popular bookies to find those that were favorable to consumers in terms of taxing their winnings. Though not 100% (in some cases) as you will realize, the following betting sites in Kenya allow you to place bets without taxing your stakes and/or winnings:

The options that exist include signing up to offshore bookmakers, using a VPN and Downloading betting apps. We have discussed these alternatives below in this page. Let’s first look at how the above betting sites without tax in Kenya work before exploring alternatives:

1. PariPesa Kenya

PariPesa is one of the top 10 betting sites in Kenya with no tax in 2026. In fact, one of the few betting sites in Kenya offering tax-free betting for stakes and winnings and also allowing various deposit and withdrawal methods that included Mpesa, Airtel Money, AstroPay, Skrill, bank, crypto and others. They also offer great odds and have some really nice features we have highlighted below.

PariPesa KenyaBonus Details

PariPesa KenyaBonus DetailsPariPesa Registration Promo Code: THN

PariPesa Kenya offers a welcome bonus where they 100% match your first deposit amount up to a maximum of 18,000 KES. New punters can use this bonus for wagering on the sportsbook and casino. Aside from the bonus, here are other positive features we found:

- Enjoy up to 18,000 KES as PariPesa welcome bonus when you register today.

- Enjoy PariPesa with NO TAX.

- Minimum deposit is only 30 KES via mobile money.

- Minimum betting amount is low at just 0.01 KES.

- Minimum withdrawal is only 120 KES via Mpesa & E-wallets like Skrill, Astro Pay etc

- User-friendly betting interface on web and mobile, including a lite version.

- Enjoy PariPesa aviator.

- No cap on maximum payout or daily winnings.

- Get up to 50% ODDS BOOST.

- Excellent customer care and support.

- Enjoy some of the highest odds in Kenya.

- 100% Bet Insurance to safeguard your stake.

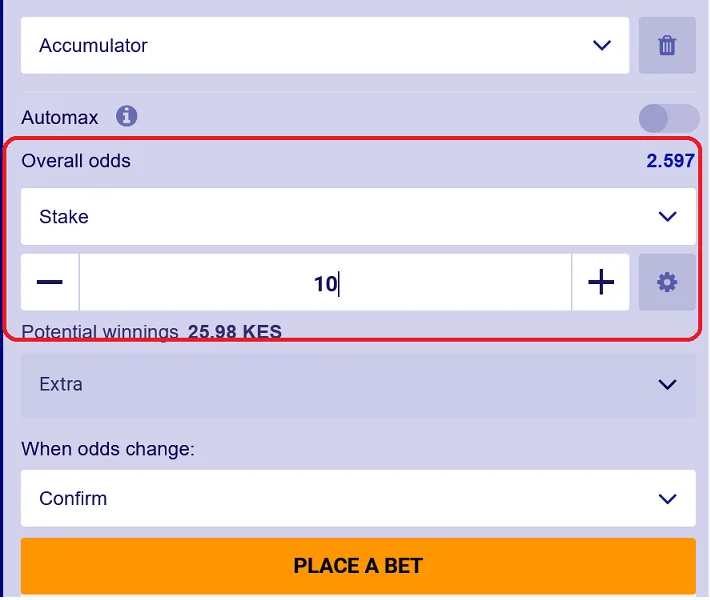

The image below shows an example of a bet slip on PariPesa and from it you can see that your stake is 100% not deducted. Same goes for winnings, as the company settles/pays the tax on your behalf.

2. Helabet Kenya

By the time of writing, Helabet was offering betting without the withholding tax on the stakes. Similar to PariPesa Kenya, they also allowing various deposit and withdrawal methods that included Mpesa, AstroPay, Skrill, bank, crypto and others. We have highlighted some of Helabet’s really nice features below.

Helabet KenyaBonus Details

Helabet KenyaBonus DetailsHelabet Registration Promo Code: THN

Helabet Kenya offers a welcome bonus where they double your first deposit with a free bet amount up to a maximum of KES 16,000. Offer open to new punters only for wagering on the sportsbook. Here is a sneak preview on Helabet features:

- Enjoy betting without tax on stakes.

- Enjoy up to KES 16,000 Helabet welcome bonus when you register today.

- Minimum deposit is only 50 KES and the deposit maximum amount per transaction is KES 150,000.

- Minimum betting amount is just KES 1.

- Minimum withdrawal is only KES 10

- Enjoy Helabet cash out feature for sports betting including live bets.

- No cap on maximum payout or daily winnings.

- Get accumulator bonus to boost your multi bets odds.

- Excellent customer care and support.

- Enjoy some of the highest odds in Kenya.

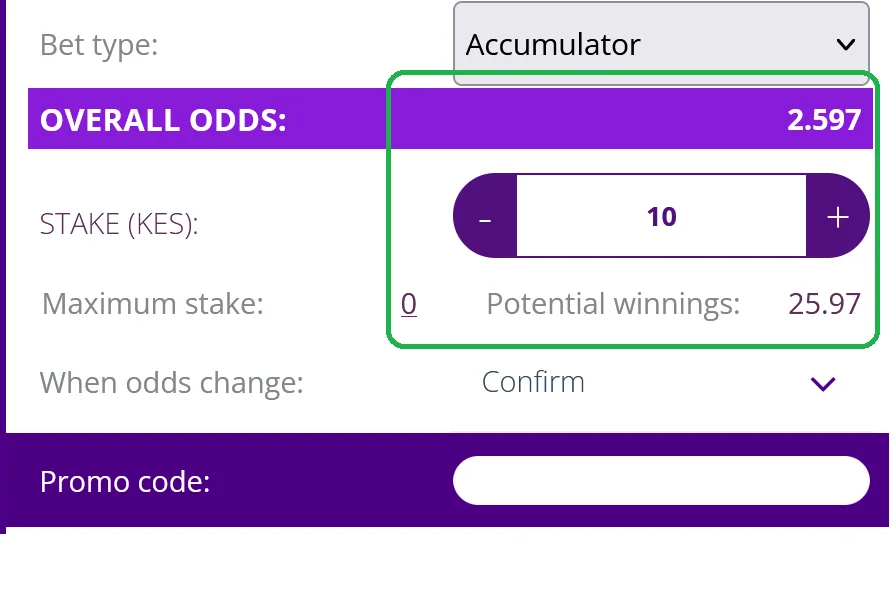

The image below shows an example of a bet slip on Helabet Kenya and from it you can see that your stake is 100% wagered in full and the excise tax is not deducted.

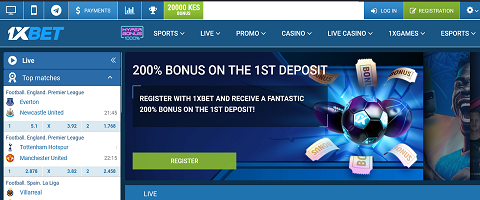

3. 1xBet Kenya

1xBet operates in a similar fashion as the betting sites without tax in Kenya, above. By time of publishing, they offered betting without tax on stakes. 1xBet Kenya also allows various deposit and withdrawal methods that included Mpesa, Airtel, AstroPay, Skrill, Bank, crypto and others.

1xBet KenyaBonus Details

1xBet KenyaBonus Details1xBet Registration Promo Code: THN

1xBet Kenya offers a welcome bonus where they 200% match your first deposit amount up to a maximum of KES 20,000. New punters can use this bonus for wagering on the sportsbook and casino. Aside from the bonus, here are other positive features we found:

- Enjoy up to 20,000 KES as PariPesa welcome bonus when you register today.

- Enjoy 1xBet with NO TAX.

- Minimum deposit is only 30 KES via mobile money.

- Minimum betting amount is low at just 10 KES.

- Minimum withdrawal is only 100 KES via Mpesa & E-wallets like Skrill, Astro Pay etc

- User-friendly betting interface on web and mobile, including a lite version.

- Enjoy 1xBet aviator.

- No cap on maximum payout or daily winnings.

- Excellent customer care and support.

- Enjoy some of the highest odds in Kenya.

- Enjoy Betgr8 tax cash-back that refunds the withholding tax.

- Minimum deposit is only 1 KES & deposit maximum amount per transaction is KES 150,000 via Mpesa & Airtel Money.

- Minimum betting amount is equally just KES 1.

- Minimum withdrawal is only KES 25

- Enjoy the cash out feature for sports betting including live bets.

- User-friendly betting interface on web and mobile, including a lite version.

- No cap on maximum payout or daily winnings.

- Get freebets for each deposit from the transaction fees.

- Get up to 500% of your stake if you lose a multibet of 7+ by only 1 game..

- Excellent customer care and support.

- Exit of International Bookies: Increased taxation has forced major brands like Bwin (Zambia), Betway, Parimatch (Kenya), and 10Bet to leave African markets.

- Emergence of No-Tax Bookies: Players are shifting to global platforms like Paripesa and Bet365 to avoid local taxes, despite limited local payment options.

- Rise of VPN Usage: Many punters now use VPNs and betting apps to bypass location restrictions and government censorship.

- Payment Innovations: Use of VISA/Mastercard, cryptocurrencies, and international e-wallets is growing as mobile money becomes harder to use on offshore betting sites.

- Continued Regulatory Pressure: With governments seeing betting as a soft revenue source, tax rates are likely to keep rising, leading to more market exits and gray market activity.

- Lack of Regulation: Offshore betting sites operate outside the jurisdiction of Kenya’s regulations and may not adhere to the same standards of fairness, transparency, and consumer protection. This can leave you with limited recourse if any issues arise. On the other hand, that may be good if your country has punitive policies such as heavy taxation on players’ accounts as is the case with Kenya.

- Security and Trust Issues: Offshore bookies may not have the same level of security measures and safeguards in place as regulated platforms. This can make your personal and financial information vulnerable to unauthorized access or misuse. If you are from the European Union, policies such as the GDPR may protect your data as a consumer and you have a right to sue for any misuse whilst in other places, the law is not clear and limits your legal recourse.

- Payment and Withdrawal Issues: Offshore bookmakers may have limited or unreliable payment options. Or, may have many options that may not be convenient. Depositing funds or withdrawing winnings can become challenging, potentially resulting in delays or even loss of funds, a times. Even in case where you use a VPN, you need experience to navigate transactional issues without breaking laws.

- Legal Implications: Betting with offshore betting companies might violate the laws of your country or region. Participating in illegal gambling activities can have legal consequences, including fines or penalties where applicable. Before opting for an offshore site, find out their policies regarding users from your country.

- Lack of Responsible Gambling Measures: Regulated bookmakers often provide responsible gambling tools and resources to help bettors manage their gambling habits. Offshore bookies may not have the same level of commitment to responsible gambling practices, which can be detrimental to individuals who may need support.

- Dispute Resolution Difficulties: Resolving disputes with offshore bookies can be challenging due to differences in legal systems and jurisdiction. You may face difficulties in seeking resolution or receiving compensation in case of disputes or unfair treatment.

- Choose reputable and licensed platforms: Stick to well-known and regulated betting websites. Research the company’s reputation, user reviews, and licenses to ensure they are trustworthy and operate legally.

- Secure your personal information: Provide your personal details only to reputable platforms with secure connections. Look for the padlock symbol in the website’s URL, indicating a secure connection (https://). Avoid sharing sensitive information through unsecured channels.

- Strong passwords: Create unique, strong passwords for your betting accounts. Use a combination of letters, numbers, and symbols, and avoid using easily guessable information such as birthdates or names.

- Enable two-factor authentication (2FA): Utilize the two-factor authentication feature offered by the betting company. This adds an extra layer of security by requiring a verification code, typically sent to your mobile device, in addition to your password.

- Be cautious with third-party applications: Avoid downloading or installing third-party applications or software that claim to provide shortcuts, hacks, or cheats for betting. These can be malicious and compromise your security.

- Regularly update software: Keep your computer or mobile device’s operating system, antivirus software, and web browser up to date. Regular updates often include security patches that address vulnerabilities.

- Beware of phishing attempts: Be vigilant about phishing scams. Avoid clicking on suspicious links in emails, messages, or advertisements. Legitimate betting companies typically won’t ask for personal information or login credentials through email or social media.

- Set deposit and betting limits: Establish limits on how much you deposit and wager to maintain control over your betting activities. This can help prevent excessive losses and irresponsible gambling behaviour.

- Educate yourself about responsible gambling: Understand the signs of problem gambling and seek help if needed. Many reputable betting platforms provide resources and options for self-exclusion or setting gambling limits.

- Be mindful of your emotions: Don’t let emotions or impulse dictate your betting decisions. Set a budget and stick to it, avoiding chasing losses or making irrational bets.

4. Betgr8

Betgr8 is owned and operated by Level X LTD, under the BCLB license number 0000435. It has been in the industry for some time now and it offers both sports and casino markets

Though Betgr8 does not offer tax-free betting, they do have a tax cashback bonus where they refund the excise tax amount on your bets if you lose in form of a free bet. However, should you win your bets, things remain normal. It is not really so much of a direct tax relief as it is conditional but still, given you would otherwise have gotten nothing, it comes as a relief. Below, are some of the other nice things we found at Betgr8 Kenya:

Betgr8 KenyaBonus Details

Betgr8 KenyaBonus DetailsBetgr8 Registration Promo Code: Mambo

Betgr8 Kenya offers a welcome bonus where they 2X match your first deposit amount up to a maximum of KES 1,000. New punters can only use this bonus for wagering on the sportsbook. Aside from the bonus, here are other positive features we found:

NOTE: Terms and Conditions apply to all the betting bonuses mentioned above. Make an effort of going through them to understand how they work.

Brief Background on Betting Tax in Kenya

In June 2021, a 7.5% excise duty was signed into law under the Finance Act of 2021. This meant that, for every 1,000 KES wagered the taxman, Kenya Revenue Authority (KRA), would toll 75 KES regardless of whether the punter won or lost the wager. In addition, punters were to pay a 20% tax on all successful bets (winnings).

That meant, if you won a 1,000 KES bet, the revenue authority would take 20% of the winnings (200 KES less the 75 KES excise). As a result, your take home would only be 925 * 20/100 = 740 KES multiply by the odds played. This is against the expected full amount without deductions that one could supposedly have won on their 1,000 KES worth bet which would have allowed them to keep all their winnings (1,000 KES).

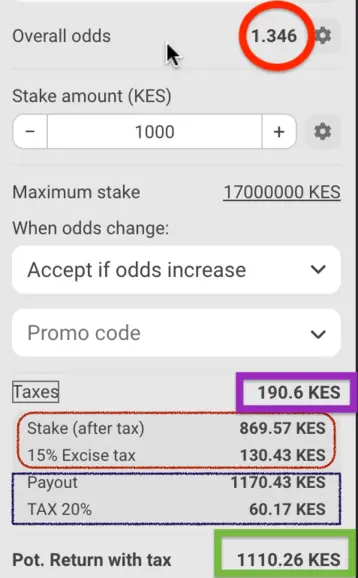

Currently, via the Tax Laws (Amendment) Act, 2024, betting companies in Kenya pay a 15 percent tax on gross gaming revenue and a corporate tax of 30 percent on profits. The firms are required to remit the taxes every day by 1 am. Whereas punters pay an excise tax of 15 percent on every betting stake and a further 20 percent withholding tax for every winning bet.

Now, if you look at these margins, it is already practically insane for punters to turn a profit given the various techniques used by professional bettors, rely on healthy spreads. Considering the fact that betting companies also pay taxes, this can only be seen as a punitive tax regime and multiple taxation.

Many would argue, the government is stretching its limits by strangling the sports betting industry; an industry that ought to be nurtured than stunted. Government as the biggest shareholder in an economy should aim at baking a bigger cake than taking large bites from small cakes thereby leaving its economy “malnourished.”

The other argument is a morality issue with some legislatures arguing betting is immoral. This argument is flawed as morality is relative to different societies. For example, in Islam, charging interest rates is immoral but in most Christian nations, interest rates have no cap. Governments in Africa also fail to recognize betting (especially sports betting) can be a profession like trading where skilled individuals can make a fortune.

The other misconstrued fact is the lack of distinction between the sports and casino books. Sports betting while risky due to the unpredictability of event outcomes, it operates just like the stock market. Users make future bets from back testing, fundamental analysis of matches, etc. And just like the stock market, human foly and cognitive dissonance such as the Gambler’s Fallacy apply.

People make and lose money all the time in the stock market, does that make markets immoral? For pro bettors and stock investors, they reckon both professions are a get-rich-slow endeavors. For stock brokers and bookmakers, they earn their money from commissions and odd margins.

That said, there is the concept of trading. Trading has often been likened to a casino where the house never losses. It is the casino games such as Aviator (crash), roulette, poker, etc where the player rarely controls fate rather aim to deal its hand. While casino games like trading can be highly in a short time frame, they carry extreme risks compared to sports betting ot stock investing.

Analysts argue it is unethical to impose a blanket tax on bookmakers for risks emanating from casinos. Others argue that while traders just like stock investors pay capital gains tax, it is fair for governments to charge a withholding tax on player winnings. Considering both sides on the debate, then it means, same rates in the stock market out to apply to sportsbooks. And maybe different rules for casinos. But this debate is up-to legislators to think through rationally.

As far as betting and casino games go, the morality argument loses weight. Rather, this is a risk management issue. Do punters/bettors understand risk? Are they playing for recreation or for gainful income (pro betting). If it’s the former, one should only wager an amount they are willing to lose. If the later, one should not only understand risks but also learn the profession.

Further in this article, we shall propose some measures to improve the betting industry in Kenya and Africa. Currently, it is safe to argue the legislative framework in the continent do not help anyone (government, consumers and bookmakers).

As a result, several firms have exited the market in the past years, citing the high taxation has significantly hit their businesses. Betsafe, 10Bet, Betway, …are just a few of the global brands that exited the local market, after the high-profile exits of Betin and SportPesa (has since resumed operations) starting in 2020.

Below is an excerpt of how a betting slip in Kenya would look after a punter wagers 1,000 KES on a single, at 1.346 odds.

That said, these are just but the reasons someone may opt for international betting sites with no tax in Kenya, despite some caveats. We shall be discussing those methods below, but first below are some of the sites that have come up with ingenious ways of alleviating the punitive betting taxation in Kenya.

Sports Betting Tax Current Status in Kenya

In the wake of budget making process of 2023, upon the installment of a new government under president William Ruto, proposed betting taxes are set to be shelved. This follows an intense lobbying against higher levies for the industry during the review of the Finance Bill 2023. The inclusion of wagered amounts in the computation of withholding tax was met by great opposition during the submission of public comments with the finance and national planning committee of the National Assembly with more than 10 submissions arguing against amending the definition of winnings.

Apart from the Association of Gaming Operators of Kenya, others opposing the new definition included Anjarwalla & Khanna, the Law Society of Kenya, PKF, Grant Thornton, the Institute of Public Finance, the Kenya Private Sector Alliance and the America Chamber of Commerce. As a result, therefore, the finance committee amended the proposed hike to excise duty on betting to a rate of 12.5 percent from the previously recommended rate of 20 percent. That signifies a 37.5% betting tax reduction on the withholding tax for betting sites in Kenya (players’ stakes).

At this stage, it just serves as a conjecture as the bill is still suspended pending a court case filed. Should the proposed amendments take effect, taxation of the wagered amount will stand at 12.5 percent or Sh12.50 for every Sh100 staked. On winnings, the wagered amounts will not be subject to tax. The association of gaming operators argued the treatment of wagered amounts as gains would amount to double taxation, hence:

“Amending definition of winnings will discourage punters for it is double taxation as the stake is already being charged with excise tax”, they argued.

In deleting the proposal on the definition of winnings, Kenyan Law Makers (Members of Parliament) essentially cushioned themselves against potential litigation with the tax appeals tribunal having previously administered a ruling in favour of separating wagered amounts from winnings. Nonetheless, protecting the gaming firms from the remittance of excise duty and withholding tax on winnings within 24 hours was however turned down. Below is how the new betting taxes as set to be collected by Kenya’s tax body, KRA.

How Betting Companies in Kenya will Remit Taxes via M-Pesa

In October 2022 in Kenya, KRA started linking to the system online betting sites in Kenya in a bid to collect taxes in real-time, via Safaricom’s mobile-money platform M-Pesa. Betting sites in Kenya as a prerequisite to the May 12, 2023 go-live date, were required to develop an M-Pesa pay tax application programming interface and a data transmission service to initiate the real-time tax remittances to KRA. The betting companies and Safaricom were to sign off on non-disclosure agreements for the service.

The service dubbed, Daraja service, is a programming interface that creates a bridge for payment integration to web and mobile applications. Through it, Safaricom will support the bulk payments by the bookmakers using M-pesa with an estimated 137+ online betting sites set to remit betting taxes on a real-time basis to the Kenya Revenue Authority (KRA) via Safaricom’s mobile-money platform M-Pesa.

KRA said the choice of Safaricom’s M-Pesa was informed by the telco’s readiness for the integration at the piloting of the new system, which seeks to allow for daily tax remittances and real-time data transmission.

“Safaricom was readily available to work with us on the pilot. However, it’s not just Safaricom as this is open to other providers,” said KRA acting commissioner general Risper Simiyu.

Betting firms are required to compute betting taxes after midnight every day and remit the same to the taxman by 7am the following morning via the KRA’s pay bill numbers. The remittances cover excise duty and/or withholding tax, charged at the new rates. The taxman argued, the integration of systems aligns with the government’s goal of collecting revenue at the source. KRA stated that the linkage will yield benefits to not just itself from a standpoint of higher revenue but also to bookmakers in the form of ease in tax compliance.

Previously, before the real-time data transmission and tax remittance era, betting taxes in Kenya were to be paid on the 20th day of the month following the month of collection.

Steping aside of the betting sites with no tax in Kenya, if you want to hunt for some crazy welcome bonus offers, here is a compilation of some of the best 10 bettings sites you can check out today.

10 Best Kenyan Betting Sites Bonus

| Betting Site | Bonus | Get Bonus |

1.  BetWinner BetWinner | 200% sign up bonus up-to 30,000 KES | Get Bonus! |

2.  1xBet 1xBet | 200% sign up bonus up-to KES 20,000 | Get Bonus! |

3.  22Bet 22Bet | 100% sign up bonus up-to 15,000 KES | Get Bonus! |

4.  PariPesa PariPesa | 100% sign up bonus up-to KES 11,800 (No Tax) | Get Bonus! |

5.  Helabet Helabet | 100% sign up bonus up-to KES 10,000 | Get Bonus! |

6.  Chezacash Chezacash | 450% daily karibu bonus up-to KES 10,000 | Get Bonus! |

7.  Kwikbet Kwikbet | 100% sign up bonus up-to KES 5,000 | Get Bonus! |

8.  Mozzartbet Mozzartbet | No signup bonus but best odds | Get Bonus! |

9.  Bangbet Bangbet | 50% sign up bonus up-to KES 2,000 | Get Bonus! |

10.  Betgr8 Betgr8 | 100% sign up bonus up-to KES 1,000 | Get Bonus! |

Looking at the broader African iGaming market, this is how the tax regimes look as far as betting tax goes.

| Country | Tax Details |

|---|---|

| Eswatini | 12.5% Betting tax on GGR; 15% WHT(Withholding Tax) on services |

| Ethiopia | 15% Excise tax on player’s stake; 15% WHT on player winnings; 15% WHT on services; 15% VAT on gaming (applied to stakes) |

| Ghana | 10% WHT on player winnings; 20% Betting tax on GGR; Growth & Sustainability Levy on profit; Tax on money transfers |

| Kenya | 15% Excise tax on player’s stake; 20% WHT on player winnings; 30% Betting tax on GGR; 20% WHT on services |

| South Africa | 6% WHT on player winnings (horse races only); 6.5% Betting tax on GGR; 15% VAT on gaming |

| Tanzania | 10-15% WHT on player winnings; 25% Betting tax on GGR; 15% WHT on services; 18% VAT on gaming (rate depends on type of gaming) |

| Uganda | 15% WHT on player winnings; 20% Betting tax on GGR; 15% WHT on services; Tax on money transfers |

| Zambia | 15% WHT on player winnings; 25% Betting tax on GGR; 20% WHT on services (rate depends on type of gaming) |

| Nigeria | Effective Jan 1, 2025: 5% WHT on resident winnings; 15% WHT on non-resident winnings (plus existing taxes) |

| Zimbabwe | Effective Jan 1, 2025: 10% WHT on all sports betting winnings (regardless of amount) |

Key Trends and Observations:

Betting on Offshore Bookies with No TAX

Betting on offshore bookies refers to placing bets with online betting companies that are based in countries where they are not licensed or regulated. For example, legit betting sites in Kenya that are not regulated by the BCLB. A number of the most popular offshore betting sites are located/registered in places Curacao, the Isle of Man, Malta and Costa Rica.

While it may be tempting due to potentially better odds, tax on betting sites in Kenya or broader betting options, among other reasons, it’s important to understand the risks involved. Here are some key points to consider:

It is generally recommended to use licensed and regulated bookmakers that operate within your jurisdiction (in our case, KENYA). These platforms are subject to oversight, adhere to strict regulations, and offer consumer protection measures to ensure a safer betting experience.

What is a Legal Sports Betting Company in Kenya? That is just a betting site licensed and regulated by betting and gaming laws of Kenya. Pretty much every site with a local mobile banking deposit and withdrawal feature. You will also tend to find the license number prominently displayed on the website at the footer section. Those are the easy ways of spotting one.

Whilst online sports betting is legal in Kenya, offshore betting sites provide an alternative way to wager for those in states where sports betting is not legal. Despite the fact that offshore betting sites may be considered illegal, there are many credible offshore betting sites that accept players from most parts of the world. They have their own advantages compared to regulated ones among them tax benefits, varied sports markets, and so on. You only need to learn how to effectively use them.

As a fact, most offshore bookies are among the best betting sites without tax in Kenya that one can explore. As a fact, you need to be savy with international as well as some universal/global payment systems like crypto, bank cards and transfers, web money like PayPal, Skrill, etc. This is because mobile money payment systems like M-pesa and Airtel, are not offered at most offshore betting sites.

Retail Sportsbooks in Kenya

Online betting is not the only option you have. If you prefer to gamble in person, then there are many in-person sportsbooks with brick-and-mortar shops around the country. You can walk into them and place your bets free of charge provided you have an account.

Some of the betting companies with physical shops around the country include; Mozzart Bet, Sportpesa, 1xBet, among others. That said, we did not find any retail betting sites without tax in Kenya. If you think by betting offline you would escape betting taxes, sorry.

That said, majority of punters love the option of wagering bets online. If that is convenient for you, nice. If you do not have the device or internet connection to access your betting account, do know that you are not limited as you can walk into any physical betting shop and place a bet there. You do get a ticket after. When your bet slip wins, you only need to return to the shop with the ticket for the payout. Alternatively, you do that by logging into your online account and cashing out.

Safety when Using Online Betting Companies

When using online betting companies, it’s important to prioritize your safety and protect yourself from potential risks. Here are some essential safety measures to consider:

Remember, online betting should be viewed as a form of entertainment (unless you are doing it pro), and it’s essential to engage responsibly and stay within your means.

Use of Betting Apps and VPNs

The other route for escaping betting tax in Kenya can be by the use of betting apps and/or a VPN (Virtual Private Network). This will require some technical guidance though. A VPN allows you to change your location on the internet to a country you do not reside. For example, as a Kenyan, you may use a VPN to register for betting sites in a country like the England where there are no betting taxes on players’ account but rather only on overall betting companies’ revenues.

Nonetheless, using a VPN may turn fatal if the bookmaker requires a strict KYC process before withdrawing your money and by this way, your money may get stuck on the sites. Another risk is when the VPN is weak leading to access denial and other risks. Use of betting apps from sites that allow Kenyans to register appear safer as with an App, you do not need a VPN as you can use the betting site even if it is blocked in Kenya. There are a few drawbacks here too but generally, safer and convenient than a VPN.

That said, always apply caution when dealing with some of the betting sites without tax in Kenya as their activities are subject to change or any happenstance occurence. As a caution, get in the habit of downloading the betting app of your favorite bookies no matter their status. It comes in handy in terms of your own digital security and safety.

Proposed Solutions for a Thriving Betting Ecosystem in Kenya

In addition, the government of Kenya does little to protect consumers in Kenya’s economy. Consumers run risks of extortion through various ways. For instance, gambling ads should be limited from mass media especially during prime time just like adult shows. Gambling Ads should carry prominent disclosure just like those in cigarettes and beverages. Betting sites should be treated fairly, just as other industries. in addition to going directly against the tenets of free market capitalism that Kenya claims to be or at least aspire.

And that’s a wrap for the list of betting sites in Kenya with no tax. What do you think? If you find this page helpful, kindly share it with others social media or link to it. Thank you for visiting, cheers and bye!